27 Nov The Rise of Co-Buying: A Modern Solution to Housing Affordability Challenges

In an era where housing affordability has become increasingly challenging, co-buying has emerged as a viable solution for aspiring homeowners. With the national median home price reaching $417,700 in Q4 2023 and mortgage rates hovering around 6.8%, many potential buyers are exploring alternative paths to homeownership. This growing trend of purchasing property with friends, family members, or even carefully selected co-investors is reshaping the traditional homebuying landscape.

Understanding Co-Buying: Benefits and Market Impact

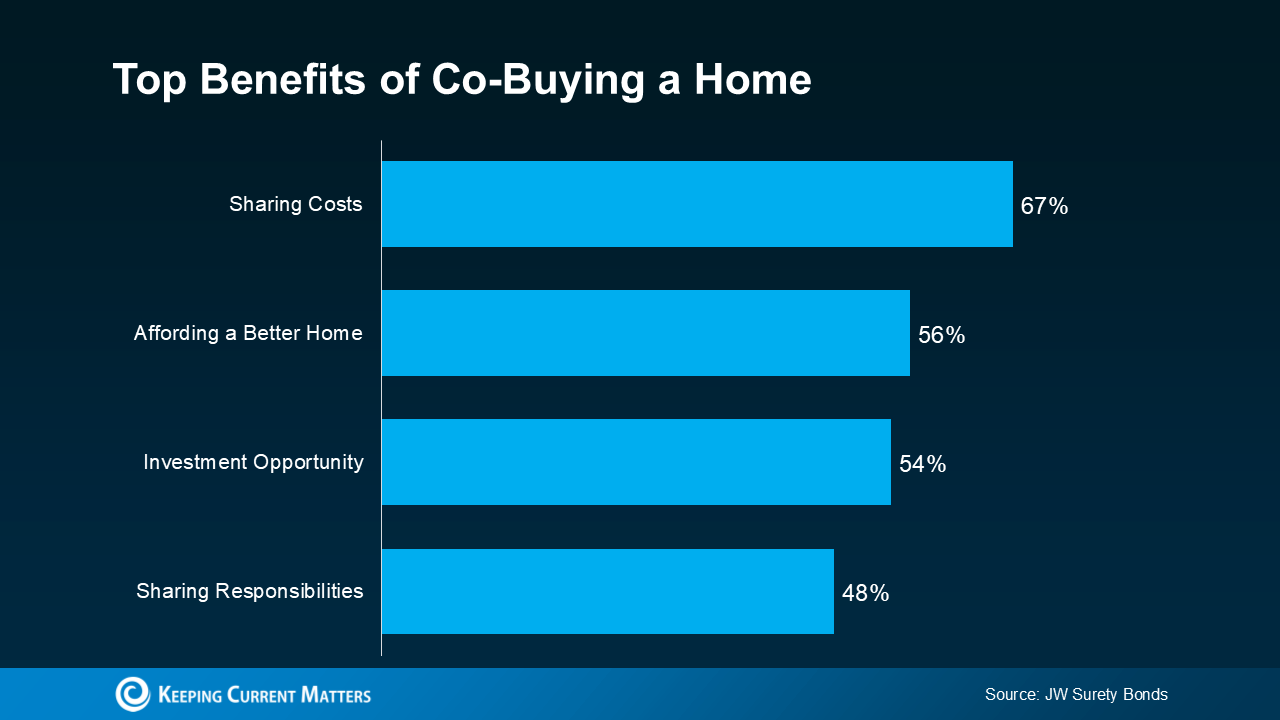

Co-buying, or joint homeownership, has gained significant traction in recent years. According to JW Surety Bonds’ comprehensive survey, approximately 15% of Americans have already participated in co-buying arrangements, while an impressive 48% express openness to considering this option. This statistical evidence suggests a shifting mindset toward collaborative homeownership, particularly among millennials and Gen Z buyers.The financial advantages of co-buying are compelling:

Recent data from the National Association of Realtors (NAR) supplements these findings, revealing that co-buying arrangements have increased by 23% since 2020. The trend is particularly pronounced in high-cost urban markets, where median home prices often exceed $600,000.

Strategic Considerations and Legal Framework

While co-buying presents attractive opportunities, it requires careful planning and clear agreements. Lawrence Yun, Chief Economist at NAR, emphasizes: “Co-buying arrangements can be an excellent pathway to homeownership, but they require thorough legal documentation and clear communication between all parties involved.”Key elements to consider include:

- Legal Structure: Options include joint tenancy, tenancy in common, or forming an LLC

- Financial Responsibilities: Clear delineation of mortgage payments, maintenance costs, and utility bills

- Exit Strategy: Predetermined agreements for selling or buying out co-owners

- Property Usage Rights: Specific terms about occupancy, guests, and common area usage

Recent data from Freddie Mac indicates that co-buying arrangements with proper legal frameworks have a 25% lower default rate compared to traditional single-buyer mortgages, suggesting that shared financial responsibility often leads to more stable homeownership.Financial experts recommend several protective measures for co-buyers:

- Creating a detailed co-ownership agreement

- Establishing an emergency fund for unexpected repairs

- Regular financial check-ins between co-owners

- Annual review of insurance policies and ownership agreements

The Co-borrowing Trend is Gaining Popularity

The trend has also caught the attention of major financial institutions. Bank of America reports a 67% increase in co-buying mortgage applications since 2021, leading to the development of specialized lending products for joint purchasers. These new financial products often feature more flexible qualification criteria and modified down payment requirements.

Mark Johnson, VP of Housing Market Analysis at Realtor.com, notes: “Co-buying isn’t just a temporary trend – it’s becoming a sustainable solution for many Americans facing affordability challenges. We’re seeing lenders and real estate professionals adapt their services to better serve this growing market segment.”Looking ahead, industry experts project that co-buying will continue to grow, with estimates suggesting it could represent up to 25% of all home purchases by 2026.

This shift is driven by both economic necessity and changing attitudes toward shared living arrangements among younger generations.For those considering co-buying, working with experienced real estate and mortgage professionals is crucial. My team and I can help navigate the complexities of joint ownership and ensure all parties’ interests are protected.

As the housing market continues to evolve, co-buying represents not just a temporary solution but a fundamental shift in how Americans approach homeownership in the 21st century.