18 Nov An Increase in Mortgage Applications Shows Strong Luxury Market

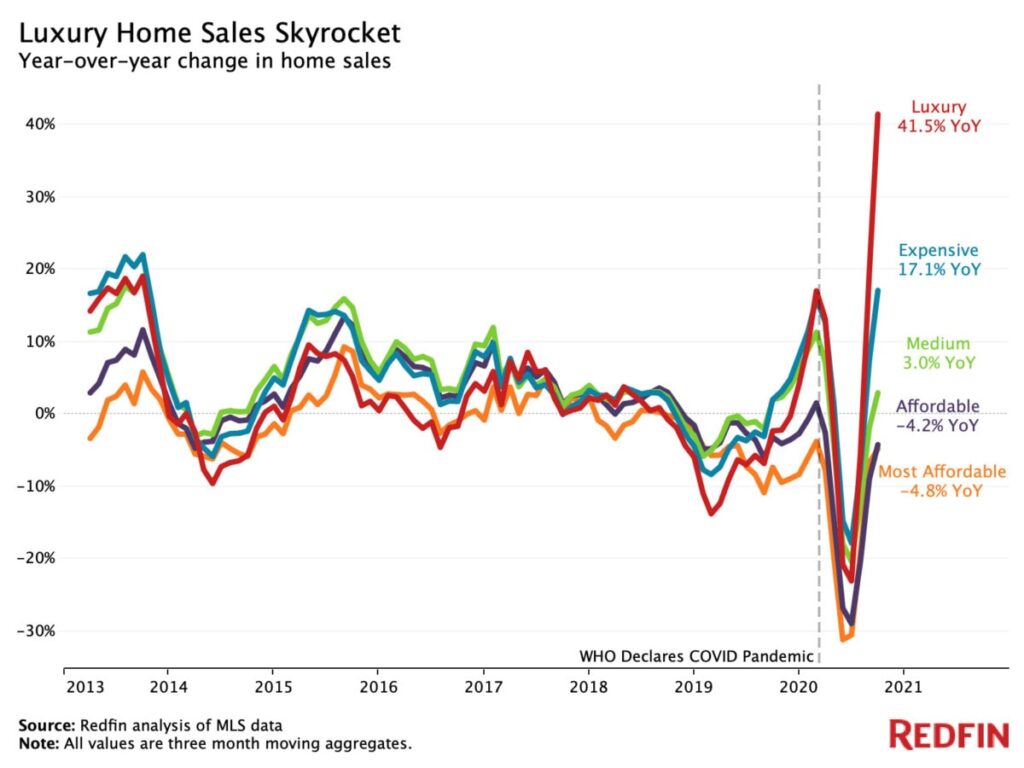

According to the mortgages Bankers Association, mortgage applications saw a 1.7 percent gain from the previous week, after consecutive declines. Positive mortgages activity plays into the surge of expensive home sales in the third quarter at a 41.5 percent increase. This gain is the largest year-over-year in seven years. Home prices continue to rise due to the limited supply of homes overall. But agents are seeing a majority of all-cash offers from luxury homebuyers to beat the competition and take advantage of the low mortgage rates.

Active properties on the market are receiving multiple offers, some reaching ten at once. High-end homes tend to stay on the market longer but are closing within weeks, if not days. For example, a realtor in, vacation hot spot, Palm Beach has been busy during the buying surge since July. A recent report conducted by Douglas Elliman and Miller Samuel saw that the average home in this area was $7 million with contracts up to 62 percent. The annual average in sales tends to be around $200 million. This year, in the first three quarters, Palm Beach agents saw this number reach $350 million worth of real estate. The Hamptons saw a 51 percent increase in year over year sales with activity ranging from 10 to 40 million-dollar deals. Brokers and agents alike are keeping busy.

The sudden surge in high-end stems from families looking for more space and mortgage rates holding at three percent or lower. Work-from-home orders are in place for the eighth month in a row for the majority of companies. People who can work anywhere from home are taking advantage of the great rates to upgrade their home with a home office and a backyard for the kids. Popular vacation areas like East Bay, California, Cape Cod, Massachusetts, The Jersey Shore, Aspen, Colorado, Miami, Florida, Jackson Hole, Wyoming, and Tahoe, California are all seeing heavy activity for homebuyers and sellers alike. More homes are being bought with all-cash offers to win the bidding wars.

“Now we’re seeing nearly every offer is almost all cash, and if they’re not cash then they have at least waived their financing contingencies including their loans and they have the ability to compete with cash offers. And many people, more this summer than any other time in my career, people have waived contingencies altogether, which is very unheard of for our market. Very, very unique.” – Tahoe Luxury Properties

Daryl Fairweather, chief economist of Redfin, has been watching the trends throughout the pandemic.

“Remote work, record-low mortgage rates, and strong stock prices during the pandemic are allowing America’s wealthy families to gobble up expensive houses with home offices and big backyards in the suburbs. Meanwhile, scores of lower- and middle-class Americans have lost their jobs or are still renting in the city because they’re essential workers and have to commute into work so, they’re unable to reap the benefits of homeownership.”

Buyers and homeowners in the high-end market have financial availability to purchase a new home. Determined buyers are offering all-cash deals or bidding way over the asking price to win the competition.

Mortgage applications and refinance have seen record-setting numbers this year due to the historic low rates. Going into quarter four, lenders saw numbers in mortgage applications and refinance jump displaying a strong luxury market. Purchase applications saw a slight 0.2 percent increase annually and a 24 percent rise over last year.

Suburbs and smaller metro areas are becoming hot spots for big-city dwellers. For example, Sacramento saw an 86.1 percent climb in luxury sales, which is more than any other metro area. Real estate agents are closing home sales quicker and with more bidding wars than usual.

“It’s well known in the real estate world that luxury properties typically take longer to sell, but this may be starting to change…Sacramento has always been a popular landing place for transplants from crowded cities but, now, with the pandemic and record-low mortgage rates, it’s becoming an even bigger hotspot for people who have the means to move. We’re seeing a lot of tech workers sell their expensive Silicon Valley homes and come out here in search of more space and more bang for their buck. A number of my buyers have been eyeing the Sacramento suburbs for a while but are just now pulling the trigger because rates are low and they no longer need to commute into work.”

Redfin also shows in the chart below that high-end home prices are outpacing the growth of affordable or entry-level homes. Luxury homes increased 6.5 percent year over year in the third quarter. Expensive homes saw a 7.2 percent increase, while the most affordable homes only grew to just under 3 percent.

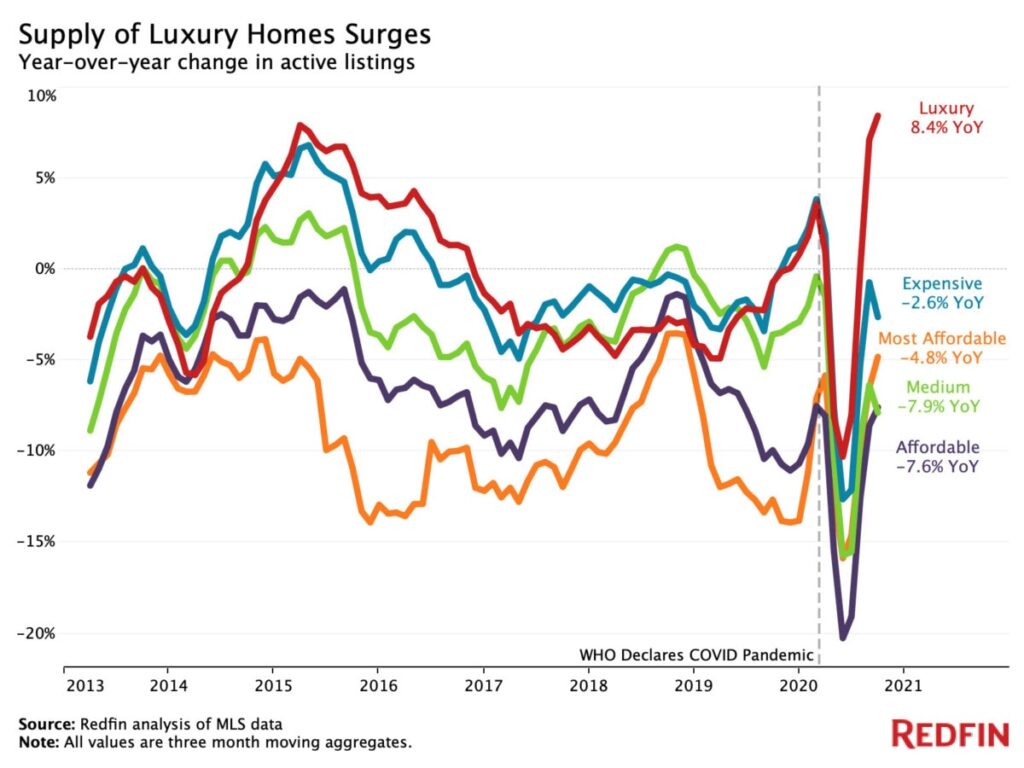

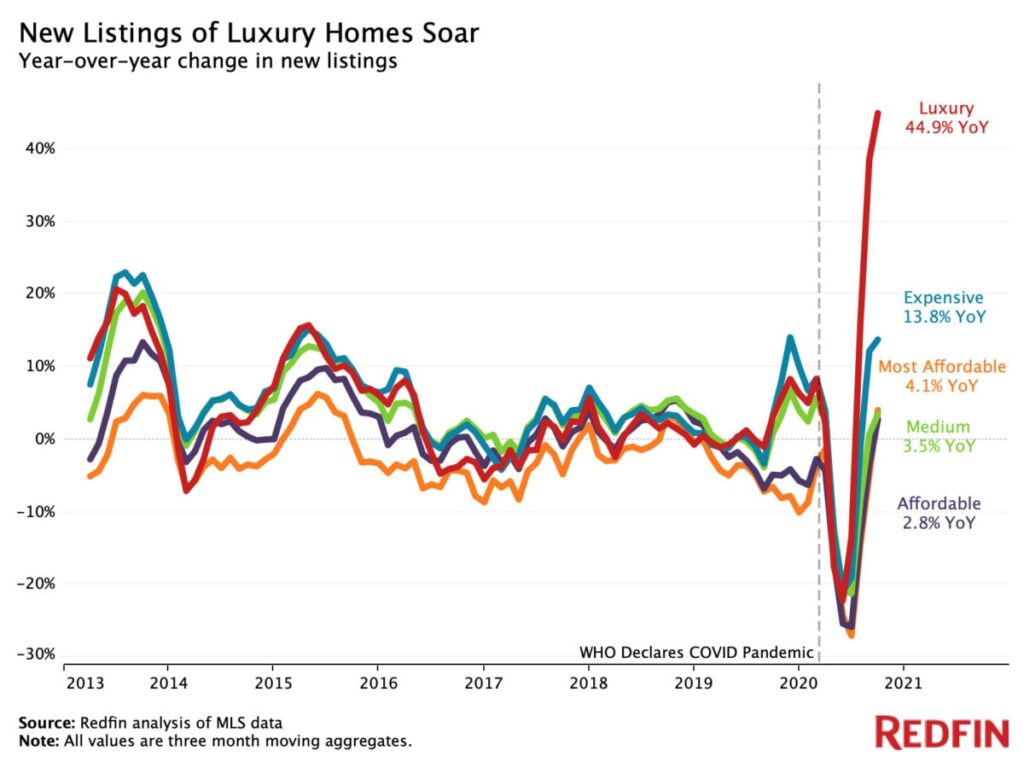

On the contrary to the limited supply crisis, the availability of luxury homes has increased. The luxury market saw an 8.4 percent gain in supply and 45 percent growth in active listings compared to every other category, which saw a decrease in active listings.

There is no telling what the rest of the fall and winter season will bring for the housing market. While the gap for available affordable homes remains an issue, the surge in luxury home sales sets a positive outlook for the rest of the year. If you are in the market for buying or selling, let’s talk! I can steer you on the right track and get you closer to the best deal possible.

This article is intended to be accurate, but the information is not guaranteed. Please reach out to us directly if you have any specific real estate or mortgage questions or would like help from a local professional. The article was written by Sparkling Marketing, Inc. with information from resources like Redfin, HousingWire, Forbes.