10 Sep September 2024 Real Estate and Mortgage Report

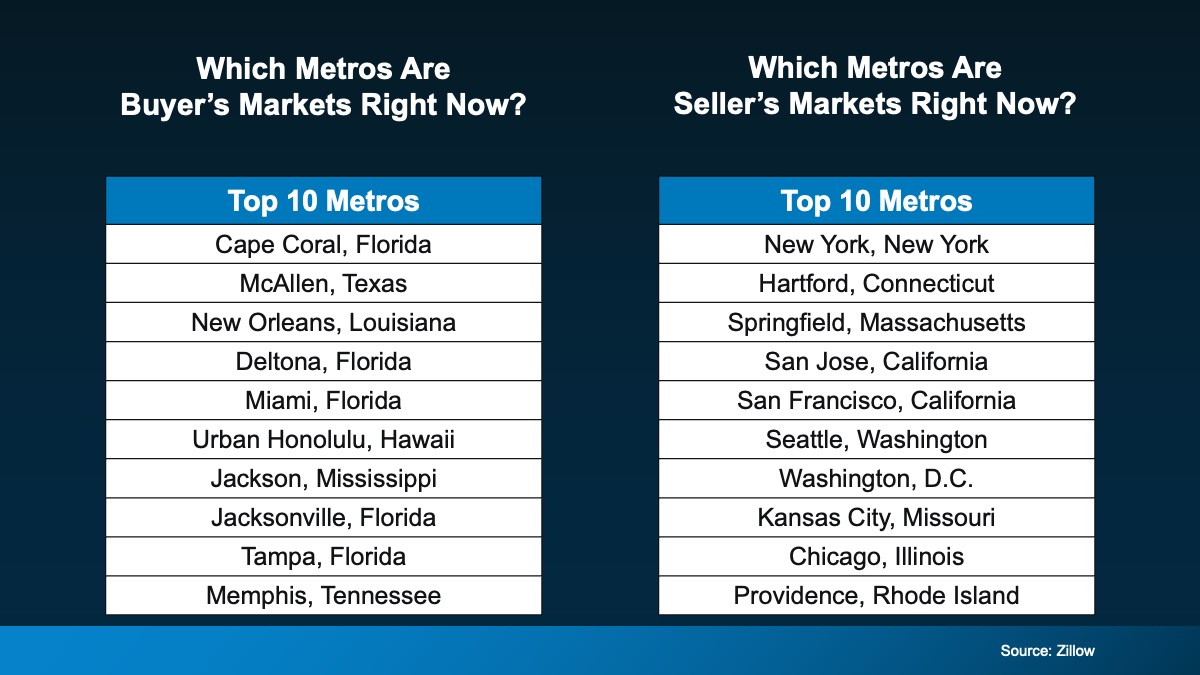

As the market moves toward more balance between buyers and sellers, parties on both sides of the transaction need to be prepared to negotiate.

As the market moves toward more balance between buyers and sellers, parties on both sides of the transaction need to be prepared to negotiate.

Insights

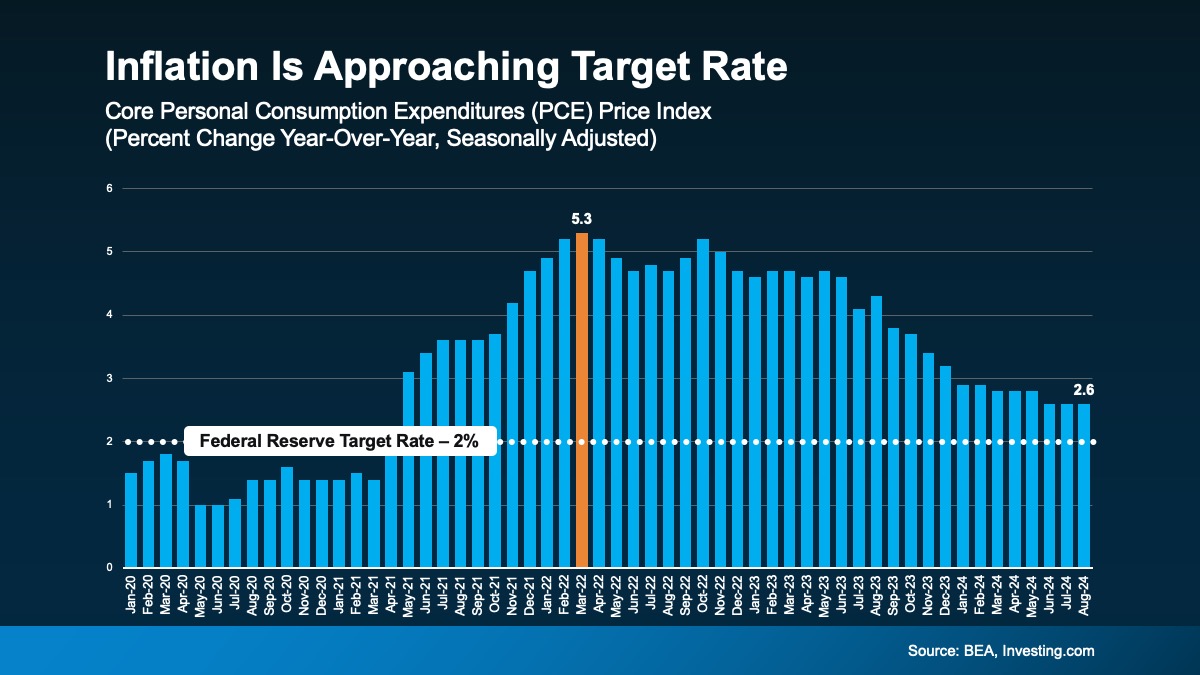

“Nearly 80% of economists surveyed by Bloomberg recently predict the Fed will make a quarter-point decrease to a range of 5% to 5.25% in September.

Money.com

“Timing the market is basically impossible. If you’re always waiting for perfect market conditions, you’re going to be waiting forever. Buy now only if it’s a good idea for you.

Jacob Channel, Senior Economist, LendingTree

Rates

Generally, the rate-cutting cycle is not one-and-done. Six to eight rounds of rate cuts all through 2025 look likely. – Lawrence Yun, Chief Economist, NAR

Generally, the rate-cutting cycle is not one-and-done. Six to eight rounds of rate cuts all through 2025 look likely. – Lawrence Yun, Chief Economist, NAR

Affordability

The faster housing supply increases, the more affordability improves and the strength of a seller’s market wanes. – Mark Fleming Chief Economist, First American

The faster housing supply increases, the more affordability improves and the strength of a seller’s market wanes. – Mark Fleming Chief Economist, First American

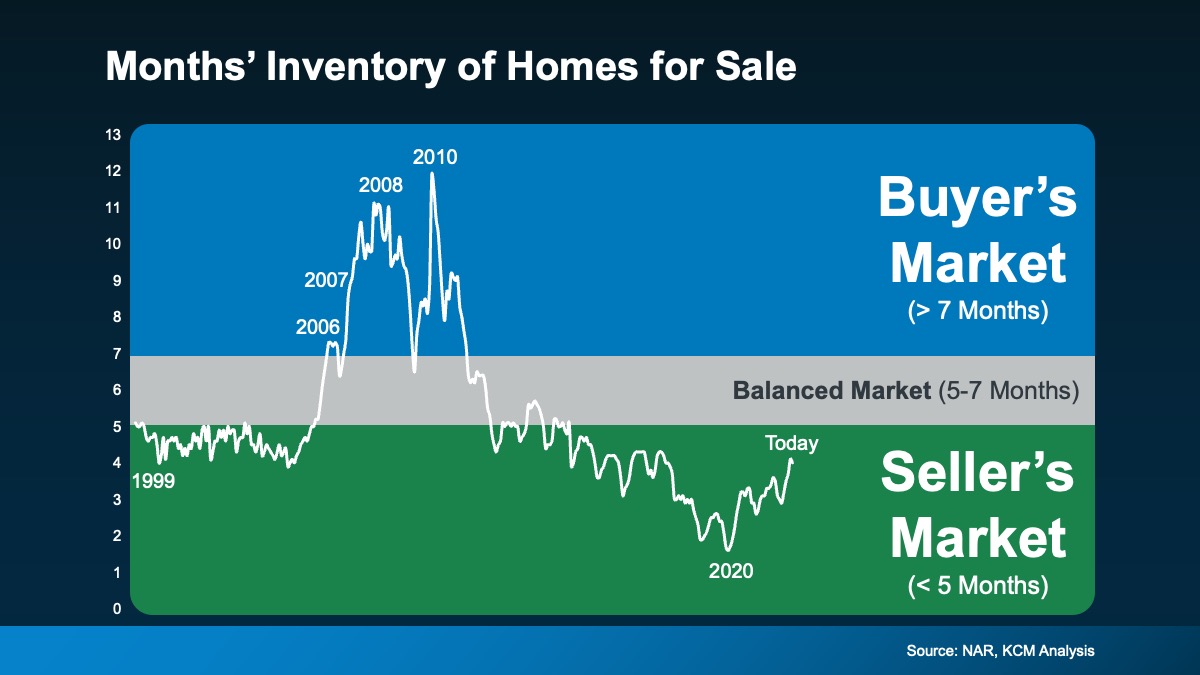

Inventory

Today’s market is considered balanced. “In general, a housing market with five to seven months of supply could be described as balanced between buyers and sellers.” – U.S. News, April 18th

Today’s market is considered balanced. “In general, a housing market with five to seven months of supply could be described as balanced between buyers and sellers.” – U.S. News, April 18th

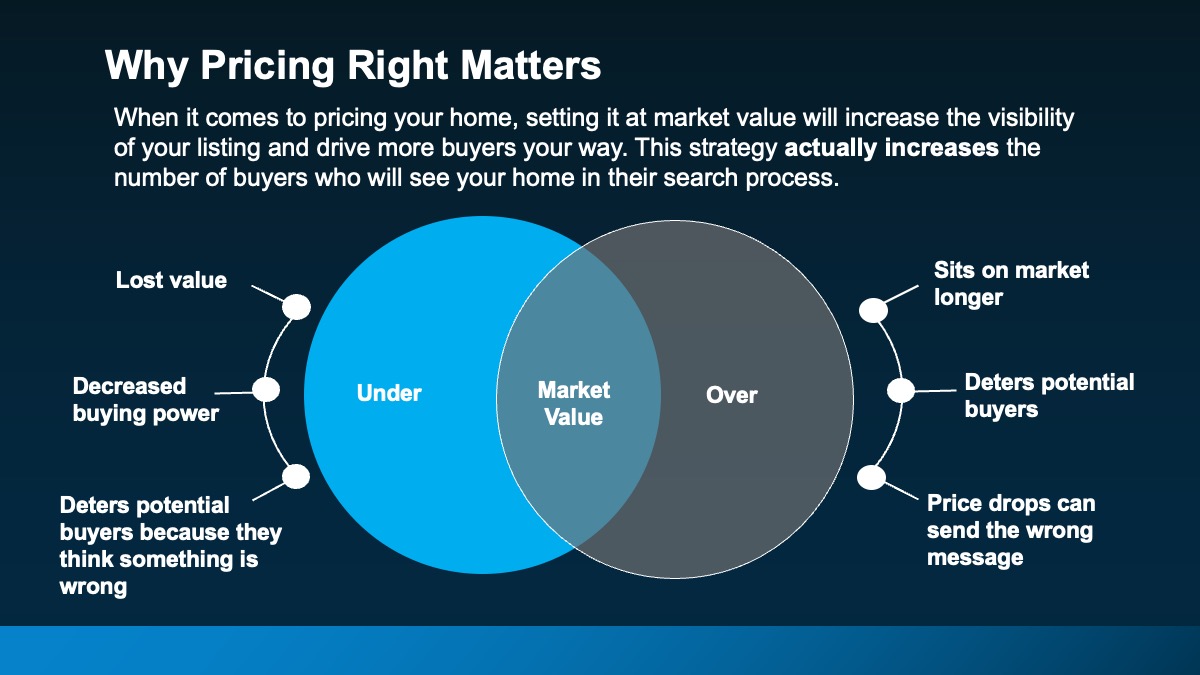

Prices

When inventory rises faster than demand, prices have to adjust eventually. Increasing inventory levels are a sign that the market is starting to balance out. – Hannah JonesSenior Economic Analyst, Realtor.com

When inventory rises faster than demand, prices have to adjust eventually. Increasing inventory levels are a sign that the market is starting to balance out. – Hannah JonesSenior Economic Analyst, Realtor.com

Sales

Homes are sitting on the market a bit longer, and sellers are receiving fewer offers. More buyers are insisting on home inspections and appraisals, and inventory is definitively rising on a national basis. – Lawrence Yun Chief Economist, NAR

Homes are sitting on the market a bit longer, and sellers are receiving fewer offers. More buyers are insisting on home inspections and appraisals, and inventory is definitively rising on a national basis. – Lawrence Yun Chief Economist, NAR

More Charts

Do you love housing data? Whether you are a real estate expert or just learning about the market, this is the data to know. Download the full report for 50+ charts illustrating the key metrics for the month.

Do you love housing data? Whether you are a real estate expert or just learning about the market, this is the data to know. Download the full report for 50+ charts illustrating the key metrics for the month.